We understand that each of our client’s situations is unique

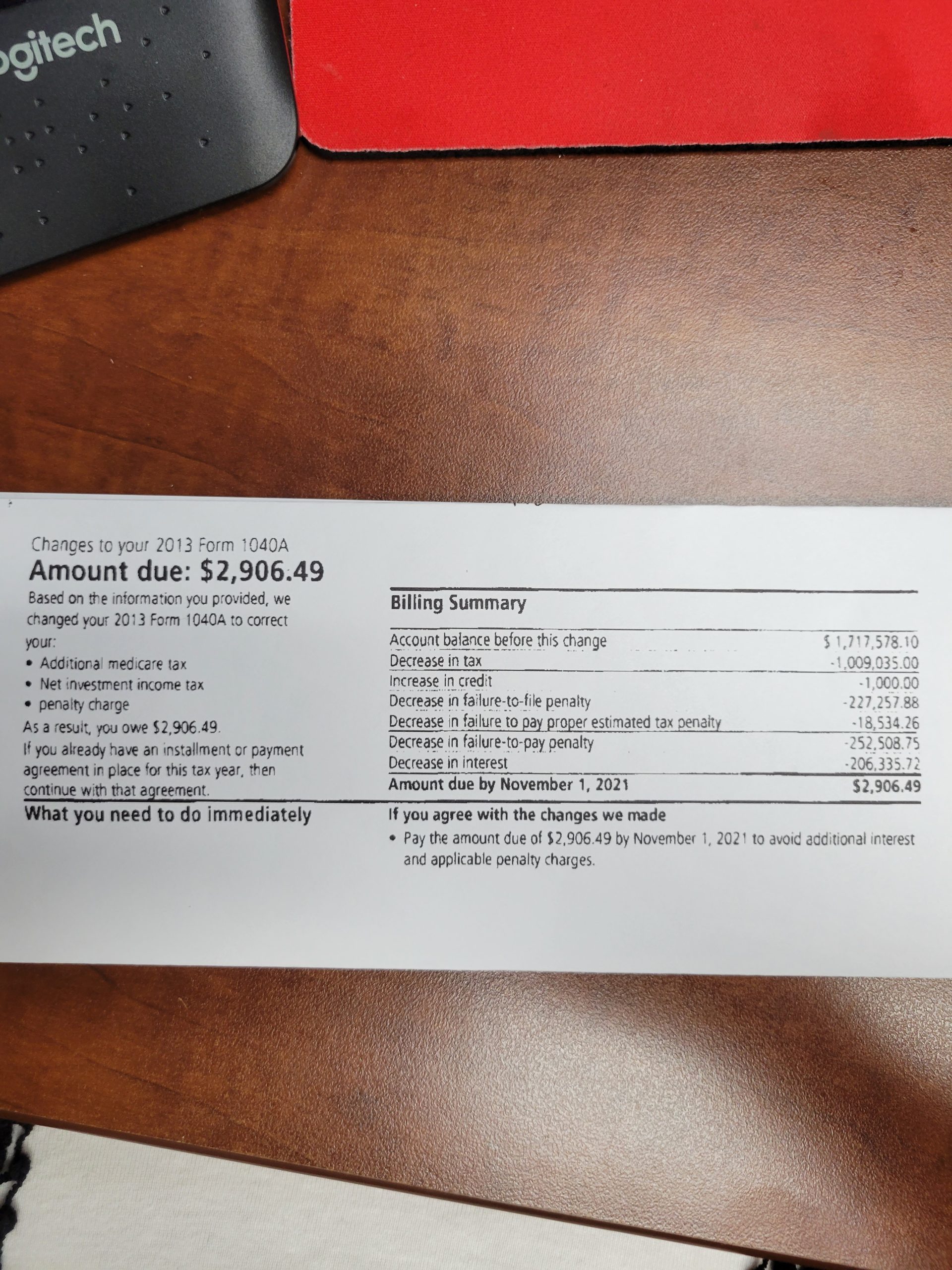

Owing back taxes can be stressful and the constant letters from the IRS does not help the matter. So what do you do now?

As a licensed tax professional Randy’s Tax Service will negotiate tax relief settlement plans for people just like you. We understand that each of our client’s situations is unique and we work to build a personalized plan of attack to get the IRS out of your life.

So what is involved in solving your tax relief?

- File an IRS Power of Attorney

This is done in order to obtain IRS transcripts to analyze your current tax status in order to best determine and advise you on your tax situation. It also establishes communication with the IRS, so you do not have to communicate with the IRS. - Prepare Financial Package

It is best to think of solving your tax relief as a very similar process to applying for a mortgage loan. In this case, you are applying for a government loan to pay back some or all of your tax relief. You will need to provide most of the same financial information to us as you would a bank. - Determine eligibility

Look for programs available to solve your tax relief.

There is a solution out there for you and we want to help you find it.

Our in-depth analysis will help us determine the best route for your tax situation.

-

We can help form a plan of action -

If you are struggling we can help give you peace of mind

Tax Lien Removal

If you have a past-due tax obligation the IRS has the right to establish a lien, or a legal claim, against your property, including your house, your business, or other assets owned by you or your spouse.

We can help you by handling your IRS Tax Lien problems for you.

Contact us today!

When the IRS garnishes your wages, part of your wages will be sent to the IRS each pay period until:

- You make other arrangements to pay your overdue taxes,

- The amount of overdue taxes you owe is paid, or

- The levy is released.

We will:

- Negotiate a release of wage garnishment.

- Arrange a payment plan with the IRS that is favorable to you.

Levy Release

IRS has the authority to collect unpaid taxes by issuing a levy against

any property and rights to property belonging to the taxpayer.

If you owe money to the IRS, they may choose to levy, or take, your

property, including:

- Paycheck

- House

- Car(s)

- Bank account(s)

- Retirement account(s)

Ignoring the IRS is not an option. The IRS will continue to take action to collect the tax relief owed, as shown by the tax levy. However, you do not have to figure it out on your own. We work to analyze your tax situation and deal with the IRS on your behalf.

For a free 30-minute consultation to see how we can help you, contact us today.